December 22, 2022: The ESG Alphabet Soup & Impact Investing

In this edition of Purposeful Finance:

- Summer Internships: Impact Investing, ESG, and Sustainable Finance

- Topic Breakdown: Impact Investing

- World: Tour De Headlines

- Market Updates: Deal Flow

Internships

GenZero is looking for an Intern – Strategy and Development

Ares Management Corp. is hiring an ESG associate and an ESG analyst in New York

PepsiCo is looking for a 2023 Summer Intern: Global Sustainability Intern

Con Edison Clean Energy Businesses is looking for a Corporate Finance Intern

Guidehouse is looking for an Intern – Energy, Sustainability, & Infrastructure Solutions – Mobility Solutions and an Intern – Commercial Sustainability – Guidehouse Resilience, ESG and Disaster Recovery

AIG is looking for a 2023 – Early Career – Strategy & ESG – Summer Intern

ORIX Growth Capital is looking for an Investment Analyst Intern

FLIT Invest is looking for a Undergraduate Campus Ambassador

BlueMark is looking for a Business Development Analyst, Impact Investing and Verification

Atento Capital is looking for a 2023 Summer Intern

Kiva is looking for a Climate Smart Finance Intern and an Impact Intern

Opportunity Finance Network is looking for an Impacting Investing Intern

CIBC (Canadian Imperial Bank of Commerce) is looking for a 2023 Summer Intern – ESG Investment

UNICEF is looking for a Finance Intern for their Education Cannot Wait (ECW) Fund

Topic Breakdown: The ESG Alphabet Soup

You might have heard the term ESG getting thrown around lately and controversial things about it. Today, we will be explaining what ESG stands for, how to measure it, measurement standards, and some recent news about it.

What is ESG to begin with?

-

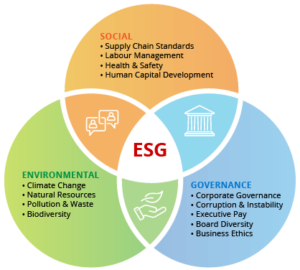

- ESG, an acronym for Environmental, Social, and Governance, is a framework that offers a holistic measurement of the impact a corporation generates beyond its materialistic goals to maximize profit.

- Environment measures a company’s interaction with the natural world through resource and energy consumption and waste discharge. Social measures a company’s relationships with people and institutions, particularly with employees. Governance measures a company’s internal system of practices, policies, and leadership.

When did ESG get “popular”?

-

- ESG has been in the know for the past decade and entered the mainstream around 2019, largely due to the push from retail and major institutional investors for companies to commit to ESG criteria.

- It also got ‘popular’ as governments have been mandating companies incorporate ESG reporting through policy. The EU will be passing the Corporate Sustainability Reporting Directive in 2023, with the US, Canada and China following suit. Many countries like the UK, Singapore, Indonesia have already passed similar legislation to require large or publicly listed companies to report their climate-related financial disclosure. This global legislative push to normalize ESG will be the next step to transition us towards a more sustainable economy.

What is the difference between ESG Reporting and ESG Ratings?

-

- ESG Reporting refers to individual companies that use standards from regulating bodies (GRI) to assess their compliance, often to report to investors or for disclosure mandated by government authorities.

- ESG Rating, on the other hand, is a metric given to companies based on the evaluation of their performance by independent third-parties. These rating platforms include the Institutional Shareholder Service (ISS), Carbon Disclosure Project (CDP) and Morgan Stanley Capital International (MSCI).

What regulating bodies are there?

-

- United Nations Global Compact, Global Reporting Initiative (GRI) Standards and Sustainability Accounting Standards Board (SASB) Standards are the most common frameworks used to measure ESG within a company.

- However, it is crucial to note that there is no one standard with ESG as it is difficult to have a single standardized framework to measure all 3 components across multiple different sectors and geographies.

What is the whole controversy about ESG?

-

- ESG has been faced with a multitude of challenges. Key amongst them is the issue of “greenwashing”, where companies present false or misleading information to market themselves under the name of ESG to boost business performance.

- The other main issue, particularly in the US, is that ESG has been facing political backlash from states like Florida and Texas, which have banned ESG Investing practices and want state funds to focus solely on pecuniary factors that maximize returns on investment.

- Beyond that, there are the longstanding issues of data inconsistency, where inconsistency in ESG scores from ratings firms is ‘a stumbling block’ when incorporating research data into the investment decisions.

Where can I learn more?

Professional Spotlight

In this week’s spotlight, we have Joellen Nicholson, Vice President and Global Director of University Impact (UI).

Why Impact Investing?

Before entering impact investing, Joellen joined Nest, an NGO, as the program director where she supported over 100 global MSMEs (micro, small, and medium entrepreneurs) with business growth strategies and local compliance matters.

“Most of the artisans that we helped were women who hired women employees nearby. These entrepreneurs typically wouldn’t be qualified for loans from local financial institutions since their revenues were small and owners usually lacked credit histories. Although these small businesses could not grow like tech businesses, they were creating great livelihoods for themselves and their women employees. Such financing inequality made me think about the importance of working with underserved, small, non-traditional business owners and what that means in the context of management, and the impact that I could contribute to the social financing area. At that moment, I knew that the impact investing space was the space for me.”

Learn more about Joellen’s journey into Impact and how she sees nonprofits and the impact investing world intersect.

World: Tour De Headlines

- Barclays updates Sustainable Financing Target to $1 Trillion by 2030. Following the announcement in February to capture opportunities from the transition to a low-carbon economy, Barclays has been investing its own capital and facilitating sustainable finance at pace, continuing to deliver against its climate strategy as endorsed by shareholders this year. (ESGNews)

- The European Investment Bank (EIB), the bank of the European Union, will lend €790 million to the Czech energy utility company ČEZ. The loan will fund the expansion of the national electricity distribution network, including the installation of automation technology and remotely controlled energy supply systems. (ESGNews)

- ExxonMobil announced its corporate plan for the next five years, with a sizable increase in investments aimed at emission reductions and accretive lower-emission initiatives, including its Low Carbon Solutions business. Their corporate plan includes growing lower-emissions investments to approximately $17 billion by 2027. (ESGNews)

- Deloitte Report: 99% of Public Companies Expect to Invest in ESG Reporting and Tech by Next Year. (ESGNews)

- UN Report: ‘Just Transition’ Policies Needed to Create 20 Million Green Jobs. New jobs and skills will be needed as we begin to see the shift we will see towards a net-zero economy. (ESGNews)

United States of America

- The Biden administration wants to make more than $2B available to Puerto Rico to expand rooftop solar and distributed energy assets. (CM)

- The Biden administration announced 5 winners for the California offshore wind auction, amounting to $757m in winning bids that will potentially power over 1.5m homes. Copenhagen Infrastructure Partners plans to build its first floating offshore wind farm with one of these permits. (DOI) (GNW)

Europe

- France will ban short haul domestic flights less than 2.5 hours long, a measure which will be reassessed by the EU Commission in three years. The ban comes off the back of a pause started in 2020 when the French government granted Air France COVID relief in exchange for canceling some domestic flight routes to encourage train 2usage. (Forbes, FT)

- Switzerland-based mining giant Glencore will close 12 of its 36 coal mines over the next 12 years to meet its emissions targets by 2035. The move comes as major miners including Rio Tinto and BHP pull away from carbon-emitting fossil fuels in favor of minerals necessary in the low-carbon energy transition, such as nickel, copper, lithium and cobalt. (FT)

Market Updates: Deal Flow

Launches

- Another week, another major battery factory announcement. American Battery Factory announces a $1.2B investment to make lithium iron phosphate (LFP) batteries in what will be America’s first gigafactory in Tucson, Arizona. LFP batteries are gaining market share to reduce EVs’ need for cobalt (TR)

Funds Raised

- PE firm Thoma Bravo raised $32.4B for three new tech-focused funds: $24.3B for Thoma Bravo Fund XV, $6.2B for Thoma Bravo Discover Fund IV, and $1.8B for Thoma Bravo Explore Fund II; their Fund XV is the largest tech-focused buyout fund ever raised (PRN)

- Swedish autonomous and electric truck startup Einride raised a $500M Series C which consisted of $200M in equity led by Northzone, EQT Ventures, Temasek, and others, plus $300M in debt led by Barclays Europe (TwC)

- HSBC-Backed Natural Capital Funds Raise $650 Million (ESGNews)

- Chicago-based credit fintech startup Avant raised $250M in preferred equity & debt from Ares (BW)

- Union Square Ventures, based out of New York, raised $200M for its second climate tech fund (The Information)

- Jenson Funding Partners, based out of London, raised €69.7M for its Aurora I Fund to invest in companies in the energy transition and sustainability (EUS)

Sustainability

- Microsoft, Nike, Common Energy Partner To Energize Community Solar in Oregon (ESGNews)

- European climate tech VC World Fund received a $52.5M investment from EU’s European Investment Fund to invest in climate-related ventures (EUS)

Healthcare VC

- Apogee Therapeutics, a biotech company developing therapies for immunological and inflammatory disorders, raised a $169M Series B led by Deep Track Capital and RTW Investments (PRN)

- CardioSense, a digital health startup focused on cardiovascular disease, raised a $15.1M Series A led by Broadview Ventures and Hatteras Venture Partners (PRN)

Affordable Housing

- Greystone Affiliate Provides $153.6 Million for Large California Development (AHF)

- JPMorgan Chase Community Development Banking has hired Rochelle Dotzenrod as division manager. Read more about her role here.

Development Finance

- IMF has approved a $319 million loan for Rwanda to finance projects tackling climate change (Bloomberg)

- UNFPA is appealing for $1.2 billion to support 66 million women, girls, and young people in 65 crisis-affected countries (UN News)

Catalytic Capital

- U.K.’s British International Investment and Nairobi-based African Guarantee Fund established a $75 million partnership to guarantee loans from lenders to small businesses in Africa, especially women-led firms addressing climate impacts (ImpactAlpha)