January 23, 2023: What is a Green Bond?

In this edition of Purposeful Finance:

- Internships in Impact

- Topic Breakdown: Inflation Reduction Act, AKA The Climate Bill

- World: Tour De Headlines

- Market Updates: Deal Flow

Internships in Impact

Investment Banking

Interested in Sustainability and Renewable Energy? Have you ever heard of Clean Energy and Renewables Investment Banking?

The Purposeful Finance team has collated different industry groups within Investment Banking where you can make a positive impact in your work. Click here to get the full list of resources! (We will be adding more soon and will release an article on this soon, do share it with friends that are recruiting!)

Join Our Network!

Here’s the quick spiel: We are currently reaching out to smaller impact funds that offer internship opportunities for freshmen/sophomores. While many firms are interested, we also need to show firms that there is interest from genuinely purpose-driven students that will apply.

If you are a freshman/sophomore and you like the positions you see below, fill out this form to get direct access to passionate impact investors and companies: https://forms.gle/TEexYGphRYNeLXcz8

Open Positions

- Pebble Legacy Partners is looking for a Remote Deal Sourcing Winter Internship – Impact Search Fund. Email athena@pebblelegacy.com with a short paragraph on why you are interested and your resume.

- Stonehenge Capital is looking for a Summer Intern – Lender/Specialty Finance. Send your resume to internship@stonehengecapital.com.

- Advantage Capital is looking for an Intern (Rolling)

- Enterprise Community Partners is looking for an Intern, Enterprise Advisors and an Intern, Investment Analyst

- Sealaska is looking for a 2023 Summer Finance & Investment Intern and a 2023 Summer Community & Economic Development Intern

- Sorenson Impact Center is looking for an Impact Strategy Intern

- Impact Investment Exchange (IIX) is looking for an Impact Investment Exchange Apprenticeships

- Nelnet is looking for an Intern – Renewable Energy ClimateTech Venture

- Jonathan Rose Companies is looking for an Investments and Acquisitions Summer Intern

- GreenArc Capital is looking for an Business Development/Client Success Intern

- APTIM is looking for an ESG Corporate Sustainability Intern and a Sustainability Intern

- Tapestry is looking for a Summer ESG & Sustainability Internships

- ZAIS Group LLC is looking for an ESG Analyst – 2023 Summer Internship

- STERIS is looking for an ESG Intern

- Serco Inc. is looking for an Sustainability Intern

Topic Breakdown: Sustainable Finance

What is Sustainable Finance to begin with?

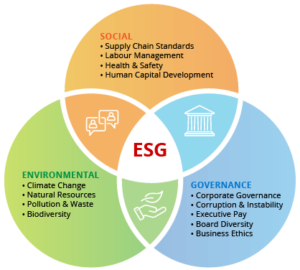

- Sustainable finance is defined by the EU Directorate-General for Financial Stability, Financial Services and Capital Markets Union and Rebecca Bakken at the Harvard Extension School as investment decisions that take into account the environmental, social, and governance (ESG) factors of an economic activity or project, not just financial return.

- A common misconception is that sustainable finance is only targeted at climate related projects. In fact, it’s a much broader term that focuses on building sustainable businesses and a sustainable economy, which covers social and governance factors as well.

- This week, we will be focusing on different financial instruments tied to ESG goals, such as green bonds, social bonds, sustainable debt and ESG investing.

Wow, that sounds like what finance should be! When did this actually become a thing?

- It was within the framework of the European Green Deal, the Commission announced a renewed sustainable finance strategy.

- The International Financial Reporting Standards Foundation set up the International Sustainability Standards Board in November 2021 to formulate new rules to validate sustainability claims.

So what exactly are the applications of sustainable finance? Are there ESG Assets or ESG Investments?

- Yes, as Sustainable Finance is very broad in scope, it covers everything from Sustainable Debt, ESG ETFs, green bonds, sustainability-linked bonds, social bonds, blue bonds etc.

- ESG financial tools are broadly split into two categories, activity-based products and behavior-based products. Green bonds, sustainability bonds and social bonds are all activity-based instruments while Sustainability-Linked Bonds (SLBs) are behavior-based.

First up: activity-based or “Use of Proceed” products

- These are products where the money raised is ring-fenced for a certain purpose or project, such as a renewable energy plant or affordable housing project. (Peep this: JP Morgan’s $1 billion social bond to support U.S. housing)

Next, behavior-based products:

- Behavior-based products are different in that the money raised can be used by the company in any way, like setting up a factory. But the bond sets certain targets for the company that the company has to abide by, for instance, to lower emissions by 20% by 2025, hence it is behavior-based.

- Sustainability-linked Bonds – such as key performance indicator (KPI)-linked or SDG-linked Bonds – are structurally linked to the issuer’s achievement of climate or broader SDG goals, such as through a covenant linking the coupon of a bond.

- Progress, or lack thereof, toward the SDGs or selected KPIs will cause a decrease or increase in the instrument’s coupon.

OK, so what’s the difference between sustainable finance, socially responsible investing, and impact investing?

- In truth, there is a lot of gray area between these definitions and many different institutions or people can define them differently.

- S&P Global and Investopedia explain socially responsible investing as a style of investing that excludes certain companies based on a specific ethical criteria, such as avoiding arms manufacturing companies or companies selling tobacco. Socially responsible ETFs like iShares ESG Aware MSCI USA ETF ESGU reflect this as well.

- From articles by Investopedia and GIIN, which produces one of the most commonly used Impact Investing frameworks, impact investing has a stronger emphasis on positive impact results than with impact investing and socially responsible investing. Impact investing is a much broader term to cover not just sustainability-focused investment, but those in social impact as well.

What is the state of sustainable finance now?

- ESG assets are projected to reach $53 trillion by 2025, a third of global AUM.

- Europe accounts for half of global ESG assets and dominated the market until 2018. The U.S., however, is taking the lead with more than 40% growth in the past two years and is expected to exceed $20 trillion in 2022, even if its pace of growth halves this year.

World: Tour De Headlines

- The PNC Financial Services Group, Inc. announced the expansion of its environmental finance commitment to $30 billion. The bank initially announced in August 2021 a commitment of $20 billion over five years in support of environmental finance. Since then, PNC has completed $9 billion in environmental financing for its customers. (ESGNews)

- ADNOC Allocates $15 Billion to Low-Carbon Solutions. The announcement follows the guidance by ADNOC’s Board of Directors in November 2022 to accelerate the delivery of its low-carbon growth strategy and the approval of its Net Zero by 2050 ambition. This builds on ADNOC’s strong track record as a leading lower-carbon intensity energy producer, which includes its use of zero-carbon grid power, a commitment to zero flaring as part of routine operations, and deployment of the region’s first carbon capture project at scale. (ESGNews)

- SK Hynix Issues Industry’s First Sustainability-Linked Bond at $1 Billion. SK Hynix Inc. announced that it successfully issued a Sustainability-Linked Bond (SLB) with a total amount of USD 1 billion. (ESGNews)

- World Bank Prices the First Canadian Dollar Sustainable Development Bond of 2023 and Highlights the Importance of Biodiversity and Nature for Development. (ESGNews)

United States of America

- The Department of Labor (DOL) announced the adoption of a final rule clarifying that 401(k) plan sponsors can consider climate and other ESG factors in investment decisions. This rule removes restrictions imposed during the previous administration that made it difficult for 401(k) and other retirement plan sponsors to include climate-aligned and other ESG funds in the list of options available to participants.

- Oregon followed the lead of California & Washington, setting to phase out new gas car sales by 2035. This means the entire West Coast aims to ban gas car sales in a little over a decade. (Autoweek)

- In a positive reversal of prior policy, the US Postal Service commits ~$10b to deploy over 66,000 electric vehicles by 2028. (CM)

Europe

- Norway’s Blastr Green Steel is planning to build a low-carbon steel factory in Finland worth $4.3 billion, one of the country’s largest industrial projects yet. The factory is set to produce 2.5m tons of green steel annually starting 2026, and will include integrated hydrogen production. (Bloomberg)

- Norway’s $1.3 trillion Government Pension Fund Global established a new climate board. The board will advise on managing climate-related financial risks and opportunities. (P&I)

- Despite the ongoing energy crisis and countries’ turn back to coal, E.U. emissions fell again last year, dropping to a 30 year low. (Forbes)

Asia

- Reserve Bank of India Launches First-Ever Sovereign Green Bonds Auction Worth $1.93 Billion. As announced in the Union Budget 2022-23, the Government of India, as part of its overall market borrowings, will be issuing Sovereign Green Bonds (SGrBs), for mobilizing resources for green infrastructure. The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy. (ESGNews)

- Islamic Development Bank Group (IsDB) President and Group Chairman, H.E. Dr. Muhammad Al Jasser, announced a US $4.2 billion IsDB Group commitment to support Pakistan’s climate resilience efforts and development agenda and the country’s vision for 2025 over the next three years. He made the announcement at the International Conference on Climate Resilient Pakistan in Geneva, addressing the devastating effects of Pakistan’s recent floods. (ESGNews)

Market Updates: Deal Flow

M&A/Investments

- Stellantis will invest $150M in Archer Aviation (based out of San Jose, CA) and partner with them on an electric air taxi design. (here)

- Finance in Motion, a German asset manager focused on ESG investing, is exploring a sale. (BBG)

Funds Raised

- General Atlantic closed $3.5B for its inaugural climate solutions fund, BeyondZetZero. (GA)

- Linse Capital raised $700m to back industrial technology companies across transportation, energy, logistics, and real estate. (BW)

- Goldman Sachs Asset Management raised $1.6B for its Horizon Environment & Climate Solutions I fund registered under EU’s strictest ESG rules. (BBG)

- Andros Capital Partners, an energy-focused investment firm, raised a $750M second fund. (BW)

- Silicon Ranch, based out of Nashville, TN, raised $375M in equity funding to develop and operate renewable energy and battery storage systems. Existing investors Manulife Investment Management, TD Asset Management, and Mountain Group Partners led. (BW)

- Cirba Solutions, a Wixom, MI-based battery recycling management company, raised $245m in Growth funding from EQT. (GNW)

- Vision Blue Resources, based out of the U.K., raised a $61M fund to invest in battery and other material innovation and supply chain companies.

- Virunga Power, based out of Nairobi, Kenya, raised $50M from Gridworks to develop run-of-river hydropower projects in Burundi, Malawi, Zambia, and Kenya. (here)

Sustainability

- Mercedes Benz plans to build a branded EV charging network in the U.S. (NYTimes)

- Hedonova, a U.S.-based alternative asset investment manager, invested $16M in a Chilean liquid-air energy storage plant. (PRNewswire)

Healthcare VC

- HighTide, a clinical-stage biopharmaceutical company focused on metabolic and digestive diseases, raised a $107M Series C/C+ led by the TCM Healthcare Fund of Guangdong. (PRN)

- Ensoma, a genomic medicines company developing one-time treatments for complex diseases, raised $85M in funding led by Arix Bioscience and 5AM Ventures. (BW)

- Cardiac Dimensions, a developer of minimally invasive treatments for heart failure and related cardiovascular conditions, raised a $35M Series D led by Horizon 3 Healthcare and an undisclosed strategic investor. (BW)

Affordable Housing

- Ares Management Corp raised ~$5B for an infrastructure debt fund. (RT)

- UK-based investment manager M&G raised $622M for its new M&G European Living Property fund to invest in student, private rented sector and retirement housing. (IW)

- Brick&Bolt, a Bengaluru, India-based home construction company, raised $10 million in funding co-led by Accel and Celesta Capital.

Catalytic Capital

- Biden-Harris Announce $40 Million for Tribes and Intertribal Consortia To Improve Recycling Infrastructure (ESGNews)

Recent Comments