Understanding the United Nations Sustainable Development Goals (UN SDGs)

The Overview – What are the the UN SDGs?

The United Nations Sustainable Development Goals (UN SDGs) are a set of 17 global goals that were adopted by all UN Member States in 2015 as part of the 2030 Agenda for Sustainable Development. As defined by the UN, the SDGs are a “universal call to action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity by 2030”.

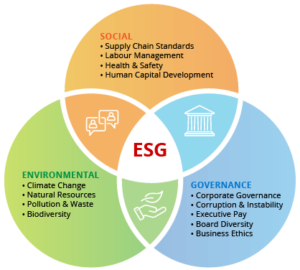

In essence, the SDGs provide the common language for all impact investors, NGOs, nonprofits and governments to articulate and quantify the impact of their work.

Why did the UN develop the SDGs? Well, you’re in for a quick history lesson.

The SDGs did not just spring out of nowhere. In 2015, they arose from decades of work by the UN. To learn more, read this article that delves deeper into the history of Development Economics. But here’s the tl;dr…

Remember the UN Human Development Index? Yeah, that was the UN’s first foray into moving away from using Gross Domestic Product (GDP) as a measure of development, shifting instead to the Human Development Index (HDI). While GDP only reflected economic growth, the HDI was used to provide a more holistic picture of development, accounting for the people’s capabilities, wellbeing and life outcomes.

Building off the HDI, the Millenium Development Goals (MDGs) were created to articulate clear targets of development with accompanying accountability frameworks.

In 2000, 189 countries signed the Millennium Declaration, a set of 8 goals they committed to achieving by 2015. The MDGs expired in 2015 and the UN SDGs were created to succeed and improve upon the work of MDGs, with new goals to be achieved by 2030.

How were the SDGs developed and by whom?

During the United Nations Conference on Sustainable Development in Rio de Janeiro In 2012, UN Member States began a consultative process to produce the Post 2015 Development Agenda. This involved specialized panels with civil society organizations, citizens, academics, scientists and businesses. This culminated in an Open Working Group (OWG) with representatives from 70 countries. The Group published the proposal and following negotiations, the goals were signed by member nations in 2015.

How are the SDGs structured?

The SDGs comprise 17 goals, 169 targets and 232 indicators. Targets break down large goals into smaller outcomes, and indicators provide exact data points that change-makers use to quantify and measure the impact of their work. To be valid, a target must contain three elements: (i) a numerical outcome, (ii) a specific deadline and (iii) a well-defined domain. This makes each of the SDGs as detailed as possible for stakeholders to be able to easily use to quantify their impact.

Need an example? We’ve included one below, but use this link to view targets and indicators of other goals:

Under UN SDG #1: No Poverty, there are 7 targets. Target 1.4 is, “By 2030, ensure that all men and women, in particular the poor and the vulnerable, have equal rights to economic resources, as well as access to basic services, ownership and control over land and other forms of property.” (shortened)

Target 1.4 has two indicators:

- 1.4.1 – Proportion of population living in households with access to basic services

- 1.4.2 – Proportion of total adult population with secure tenure rights to land, (a) with legally recognized documentation, and (b) who perceive their rights to land as secure, by sex and by type of tenure

Now that we know how it works, why do I hear about UN SDGs everywhere and what makes them so significant?

In many ways, the UN SDGs are a set of goals that we have globally agreed upon as the most important themes to work on. Hence, they essentially form the foundational principles used by governments, nonprofits, NGOs and impact investing organizations. These organizations align their work to one or more of the UN SDGs to measure the impact of their work.

Put simply by KBIGI, “‘impact can be difficult to quantify. We simply can’t add the benefits of clean water to reduce carbon emissions or add safer food to increase food production.”

Ok, so why is impact investing needed to reach our UN SDGs?

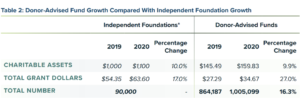

In order to achieve the UN SDGs by 2030, we will require an investment of US $3.3 – 4.5 trillion per year in investments. There is currently an annual funding gap of US $2.5 trillion a year as investments from governments and development agencies are insufficient. This is where impact investing is needed – private sector investors and asset managers are critical in closing this funding gap.

How do UN SDGs help impact investors in their work?

This report from the Global Impact Investing Network profiled impact investors to show how SDGs were important to them. Read it in full here, but we took excerpts to explain some key points.

- Providing common language: In the words of Encourage Capital, we see that the UN SDGs “are a useful framework to contextualize, communicate, and align impact objectives amongst a broad group of stakeholders, including governments, development finance institutions (DFIs), investors, and nonprofits.”

- Ensuring alignment to broader, global goals: Again, according to Encourage Capital: “the SDGs provide context for impact investors to see how their strategies and objectives fit into broader sustainable development efforts.”

Interesting, can you break down how exactly impact investors use the SDGs?

Mapping: Many impact investors have started the process mapping – matching investment goals or outcomes to corresponding UN SDGs. (Some examples include: KKR, KBGI’S Methodology, pg 23 of Builder’s Fund Report, pg 10 of Bain Capital Double Impact’s Report)

Quantifying Impact: The 232 indicators provide tangible data points that investors and changemakers can focus on to quantify the impact of their work. For instance, every investment from KKR’s Global Impact Fund (report) is mapped to specific UN SDG targets and even indicators and you will find the same with Nuveen. (Check out pg 15 of Nuveen’s Report)

This all sounds great, but it can’t be all sunshine and rainbows right?

Yes, there are many difficulties in applying the SDGs to impact investing. One key problem pointed out by SDG Impact in this report is that “there is no common set of assurance standards to ensure that an investor’s impact management practice is ‘SDG-enabling’.”

Other key problems include tackling the lack of data quantifying the impact of investor dollars and the short-termism in investor timelines as opposed to the long term timeline taken by the SDGs.

Thanks for reading, we hope this article was helpful in understanding the UN SDGs and how they are used in impact investing. If you want to get articles like these directly in your inbox, subscribe to our newsletter by dropping your email on our blog page!

Recent Comments