At Scholars of Finance, we have six core values that are at the center of what we teach: Integrity, Compassion, Humility, Curiosity, Impact, and Courage. Each month, our members vote on the “Value of the Month”, which helps focus our discussions on topics pertinent to that value.

Humility was our value for May and we spent a lot of time thinking and talking about it as a community, so I wanted to share some thoughts on this value as we enter the summer. Here are our epithet and principles for Humility:

Humility

Know thyself

- Serve a purpose greater than yourself

- Cultivate gratitude for what you have

- Recognize both your strengths and limitations

- Ask for and share honest feedback regularly

In today’s society, “Humility” is often synonymous with “Modesty”. According to Merriam-Webster’s dictionary, Humility is “the state of being humble.” Both it and humble have their origin in the Latin word “humilis”, meaning “low.” The definition of “humble”, in the dictionary, is “not proud or haughty: not arrogant or assertive”. Many people think it means having a “low” opinion of oneself – that it is the opposite of “arrogance”.

The Scholars of Finance view of humility, however, which we have been taught by our mentors and leading thinkers, philosophers, and spiritual teachers, actually places humility at the center of a spectrum between modesty and arrogance. It’s not thinking too highly or too lowly of oneself. That said, we believe humility can be summed up in two practical ways:

- Accurate self-appraisal; and

- Overcoming our ego.

David Brooks captures both points beautifully in his book The Road to Character, when he writes, “Humility is accurate self-awareness from a distance. It is moving over the course of one’s life from the adolescent’s close up view of yourself, in which you fill the whole canvas, to a landscape view in which you see from a wider perspective, your strengths and weakness, your connection and dependencies, and the role you play in a larger story”. We view humility as overcoming our ego so we know the truth about ourselves holistically. I’ll unpack this using our epithet and principles.

Know thyself

In order to know ourselves, we need to see ourselves clearly. Our egos can be fragile, and fragile self-perception often gets in our way in life.

When we read David Brooks’ writing, we see a few ways in which it is difficult for us to know ourselves. It is difficult to face our strengths and our weaknesses. We hear people say they are “self-made”, having difficulty acknowledging how everyone in their lives leading up to that point played some role in who they are now. Often, when we see “the role we play in a larger story” it can throw some of us into an existential crisis, facing how infinitesimal our lives may be in the grand scheme of things – in a world of eight billion people and in thousands of years of recorded history.

The principles of Humility outline four critical components of a “system” that helps us to know ourselves, empowering us to overcome all of these potential obstacles.

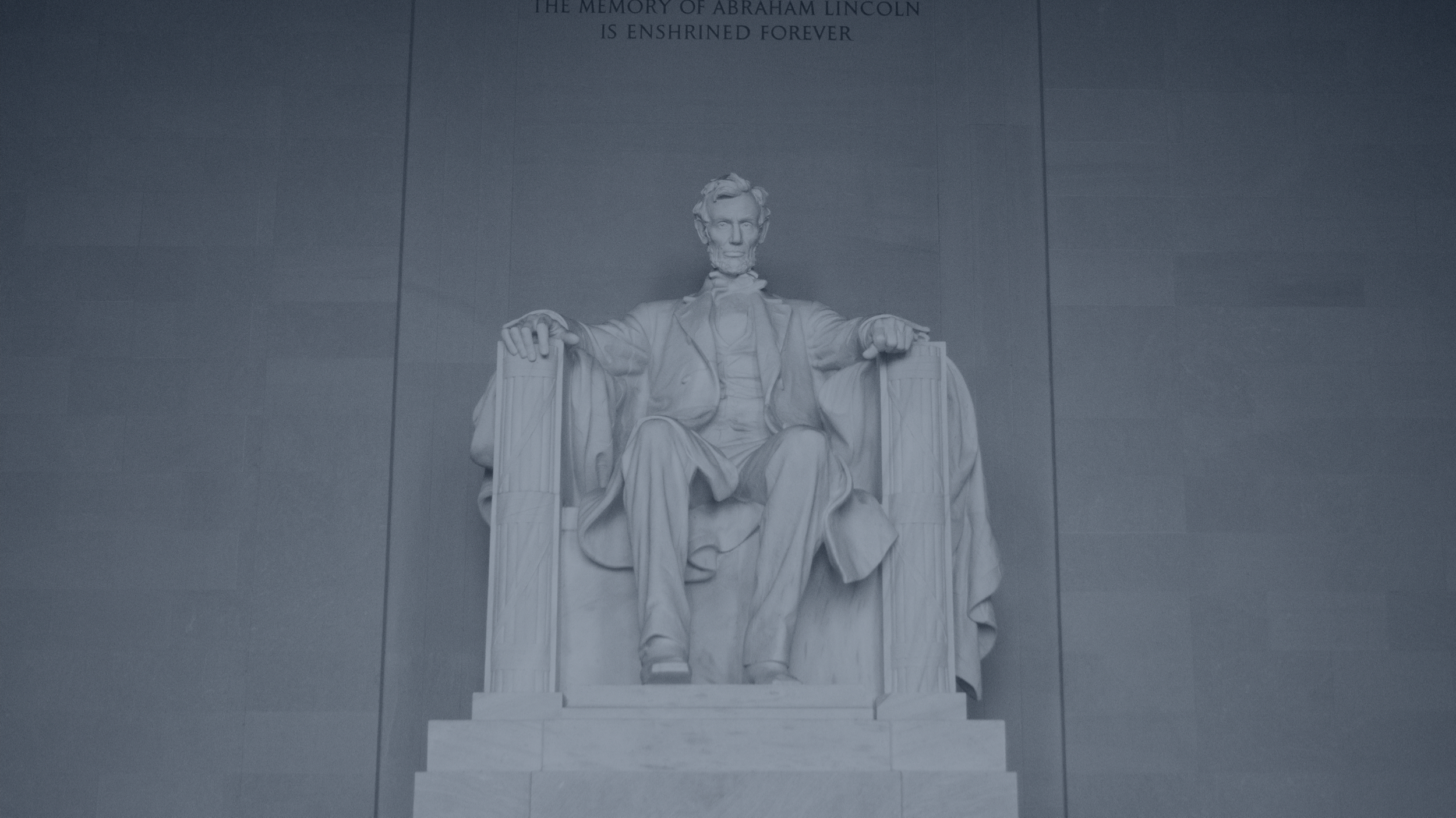

Serve a purpose greater than yourself

To diminish the ego, we need to work against self-centered tendencies. The primary way we can do this is by focusing on serving a purpose greater than ourselves so our daily life is not “all about me”. Doing so keeps us focused on the bigger picture, so we don’t become self-obsessed or begin to think we are the center of the universe. When we focus on ourselves too much it can feed our egos. Conversely, a focus on others reinforces altruism and selflessness. It is the antidote in (and through) action.

Cultivate gratitude for what you have

Greed, as we often discuss, is one of the largest risks to our character that we face in the finance industry, and the cause of many of the problems in the system we have seen throughout history. We do not believe “Greed is good”. Greed is thinking “I need more” or “I don’t have enough”, when we have more than we actually require. On the contrary, Gratitude is feeling, thinking, and/or knowing “I am content with what I have” or “I have enough”. Gratitude empowers us to experience contentment – this repels fear and anxiety, which can often be self-centric. Gratitude is our day-to-day shield against a relentless pursuit for more.

Recognize both your strengths and your limitations

Our ego – our sense of identity – often needs to protect itself, so we run from the less convenient realities about who we are. However, being open to even the hard truths about ourselves keeps us attuned to reality. Embracing these hard truths stops us from falling into a fragile-ego-protection trap, where we are blind to our own limitations. By recognizing both our strengths and limitations, it keeps us in the center of the spectrum we opened this post with and allows us to have an accurate sense of self. It ensures that we don’t become too modest or arrogant either. We have a full and balanced view of ourselves.

Ask for and share honest feedback regularly

Lastly, we can only see a part of the picture of ourselves. Because we are an interdependent social species, how others perceive us is also important. While our self-esteem should be intrinsically sourced, others can and will often see strengths and limitations, realities about ourselves, that we won’t see on our own. They help us see blind spots and tell us how our behavior impacts others. By asking for and sharing feedback, it creates an environment where others will help us to stay in touch so our egos don’t blind us to difficult truths.

Conclusion

At Scholars of Finance, we need to take a wider perspective because of the impact investments have on the world. There are several truths about ourselves we need to remain constantly aware of.

- If we achieve our goal of instilling stewardship and integrity in the finance leaders of tomorrow, we will be managing billions of dollars one day and have great influence. We need to take this very seriously.

- We are in a culture and society that venerates wealth – in a system that has perpetuated increasingly divergent socio-economic disparity – and we can easily be influenced by our environment.

- Focusing on our own needs is healthy inasmuch as it equips us to be our best, but too much self-centric focus can stop us from seeing the bigger picture.

- In Wall Street, greed can easily creep in, slowly, gradually over time, almost imperceptibly, and can undermine our better intentions and desire to help others.

- Our success in finance can get to our heads, our egos can get inflated as our sense of self swings toward arrogance, making us more prone to selfish behavior, greed, and ethical lapses.

Preparing for those risks is at the core of our mission at SOF and Humility is a value that requires a lifetime of constant cultivation. We never “arrive”, we only constantly improve (sometimes face setbacks), and continue to develop humility. It’s a plant that needs to be watered regularly to grow and thrive. So, our community encourages you to test the four principles.

As we begin to enter the summer season and many of you begin new internships, or for the investors reading, you prepare to close deals, go back to the office, and continue to advance your careers, we invite you to join us in thinking about how you are exemplifying humility in your life and work.

- Revisit your mission and values – are they bigger than yourself? Do you have them written down and does your greater purpose resonate and feel real and personal?

- Express daily gratitude, whether it be alone, with friends, or even asking others what they’re grateful for; list 5 things you’re grateful for today.

- Take an inventory of your strengths and your weaknesses, perhaps with 15 minutes of journaling time this week.

- Ask 10 people in your life for 360 feedback. Find out what your mentors, family, friends, and other peers think about you holistically.

Doing these things will help you play to your strengths and manage your weaknesses, will strengthen your relationships, and will help you to do more good and make a greater impact on people. And in the spirit of humility, these practices will help us know ourselves so that we can overcome ourselves and be true stewards.

As we venture into June and our value of the month is “Curiosity”, I would love to hear what you learn. Feel free to reach out and share your thoughts or questions. At SOF our greater purpose is to inspire character and integrity in the finance leaders of tomorrow. We’ve made progress but still have so much to learn. We would be grateful for your honest feedback.

“Um… I-” I stuttered as my interviewer raised his eyebrow at me. I felt the heat rising to my face slowly until words clumsily stumbled out of my mouth, barely coherent. It was transparent to the four upperclassmen in the room grilling me that I was grossly underprepared. The next hour crept by, each question stinging me harder than the latter. My lack of knowledge was apparent. Finally, the hour was up, my torture was over. I gathered my resume and stumbled out of the room, frustrated. It was the first month of business school and I was already struggling.

“Um… I-” I stuttered as my interviewer raised his eyebrow at me. I felt the heat rising to my face slowly until words clumsily stumbled out of my mouth, barely coherent. It was transparent to the four upperclassmen in the room grilling me that I was grossly underprepared. The next hour crept by, each question stinging me harder than the latter. My lack of knowledge was apparent. Finally, the hour was up, my torture was over. I gathered my resume and stumbled out of the room, frustrated. It was the first month of business school and I was already struggling.

Recent Comments