An Interview by Purposeful Finance

About Joellen Nicholson

Ms. Joellen Nicholson is the Vice President and Global Director of University Impact (UI), where she partners with universities in providing capital to social ventures that solve social and environmental problems.

Joellen started her career at Martha Stewart Living Omnimedia, a US omnimedia and merchandising company. In 2010, she moved to Cambodia where she co-founded and managed the scale-up of a manufacturing startup called Basik 855. In 2016, she launched the Gap for Good branded sustainability program for Gap, Inc. in five of its global markets.

Later Joellen joined Nest, an NGO, as the Program Director where she supported over 100 global MSMEs (micro, small, and medium entrepreneurs) with business growth strategies and local compliance matters.

Joellen has a Master’s in Social Innovation from the University of Cambridge and a Bachelor’s in Supply Chain Management and Marketing from Michigan State University.

Joellen’s Early Career Path & Background

How has your career evolved? Could you share your early career path?

I started my undergrad at Michigan State University studying international relations and switched to studying supply chain management and marketing. I wished there had been a University Impact around that time!

My business career first took me to New York City, where I began my career in retail home and apparel at Martha Stewart and was a buyer there until I was moved into marketing. I had the fortune of being young during the first tech wave and helped to launch Martha Stewart’s website and E-commerce platform and formed partnerships with AOL and Yahoo right when the digital advertising wave began.

Then, there was a tech boom, also known as the dot-com bubble. Even though workers were being laid off, I landed a full-time position in the National Hockey League (NHL), which transitioned my career into the sports world. My career took off from there as I became an expert in consumer and data marketing.

Could you talk about how you started Basik 855 and what you learned from that?

During my career, I felt that my actions were not making an impact in people’s lives or having any international exposure. In addition, I am also very passionate about women’s livelihood creation. I strived to create better opportunities for women, whether that be here in the US or internationally.

It was then that I started thinking about opening businesses overseas in developing and emerging economies. I researched the women’s livelihood in those areas, talking to emerging leaders about how they carry out their lives. I was working at an agency at that time and decided to take a sabbatical to use my skills to volunteer overseas.

The sabbatical landed me in Cambodia for a three-month (or so I thought) volunteer trip to work with a small NGO producing artisan products. In the process, we realized that many of the NGO workers did not understand the retail business, how to price products and how to enter new markets during expansion.

How did you respond when you realized the business challenges with the NGO?

Our team decided to transition our NGO into a for-profit venture under Fair Trade principles, so I co-founded the company Basik 855. We launched our weaving center and transited our team of artisans out of their homes into a central workshop making hand-woven textiles, fashion, and home products and helped them to promote products to the marketplace. In addition, we hired a team of approximately 54% women to work alongside men as supervisors where they could thrive and be seen as women leaders.

After 2 years, I eventually came back to the United States where I was hired as a consultant at a global customer data science consultancy company while I still managed Basik 855. Eventually, it became difficult running a small business, setting up centers in different countries, and managing sourcing for Basik 855.

What happened to Basik 855 and what did you learn from the experience?

There was an inflection point when the artisan product sales were not growing as we expected because our products were too ahead of the market at the time, but expenses continued to increase. Ultimately, we ran out of funding and were forced to close down Basik 855. Stepping away from that chapter in my life after everything I did was tough. I would say that was my first foray into understanding the importance of the accessibility of capital.

Transitioning to a Career in Impact Investing

How did that lead you to GAP and Nest, and what drove you to choose a career in impact investing?

The opportunity to return to the United States led me to find a position as a global director for Gap where I was able to combine my corporate background and previous experiences working with artisans to develop specific artisan business-focused programs. We made a significant impact by implementing innovative technologies to save water in the denim-making process and improve the sourcing process for materials.

This opportunity got me back on my feet and led me to work for an organization called Nest – a nonprofit that focused on Fair Trade Practices, sustainability and diversity – such as hiring a diverse workforce of artisans and craftspeople in the global market. I was able to combine my corporate background and previous experiences working with artisans to develop the first worker assessment program for artisans to create the workshop out of their homes.

What specifically did you do at Nest?

In Nest, I launched two major programs. One was an accelerator program, which was a year-long program for 10 artists in businesses around the world who would receive curated personalized programs to establish the workshops in their residences. Our team would work side by side with them to assess their business progress and create business plans to help their business needs including funding.

Simultaneously, we partnered with Mastercard Center for Inclusive Growth to launch Nest’s Makers United program in Birmingham, Alabama, in order to establish an inclusive and greater gender equal environment to support small artisan business owners to grow their businesses.

For both of these programs, our work focused on strengthening artisan businesses and supporting their access to local and global value chains to sell products. At the end of the day, selling products was the path to a sustainable business that could provide jobs to artisan women. Being able to grow also requires capital, and a challenge for these artisan businesses was having the money to grow.

How did working with these women and small businesses shape your perspective on impact investing?

While these small businesses could not grow like tech businesses, they were creating great livelihood for themselves and their women employees. This financing inequality made me think about the importance of working with underserved small non-traditional business owners and what that means in the context of management and the impact that I could contribute to the financing area. At that moment, I knew that impact investing for me. This is what landed me here at University Impact – helping individuals gain access to capital, expanding these businesses, and creating jobs.

University Impact: Donor-Advised Fund

Could you touch upon how the donor-advised fund works at University Impact? How do you think the non-profit world and the impact investing world intersect?

University Impact is a donor-advised fund and a 501(c)3 nonprofit, which means that people are donating contributions to us to get a tax deduction when they give to organizations.I believe similar contributions are being made when you’re looking in the world of nonprofits, inclusive finance, and innovative finance. We are adept at bringing in a plethora of capital from a donor-advised fund.

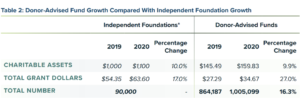

In the 2021 Donor-Advised Funds Report, there was an estimated $160 billion in DAF charitable assets generated and a $35 billion total money in DAF grant dollars in 2020, which is a 10% larger increase than independent foundations.

So the question is, how could we direct some of this money across the financing spectrum beyond traditional grant making?

Traditionally, it just came in the form of grant money from the US, so how does our team look at other areas we could be distributing this money to create a greater impact? That is what University Impact has tried to do to differentiate itself from traditional funds.

We could have done a grant program that you can give to any kind of organization. There are plenty of 501(c)3 nonprofits that have good standing with the Boys and Girls Club, YMCA, and even your local church.

However, our team is focused on answering what else there could be. How can we find organizations around the world that may need a grant, but also look at how they are impactful as business ventures? Our team focuses on doing recoverable grants, and credit guarantees for all different types of funding vehicles. That is how University Impact has built its financing structure.

Why go with a Pay for Success model?

When you look into the broader world, the Pay for Success model introduces a new way for governments to finance social services and target limited dollars to achieve a positive, measurable outcome. This likelihood opens up opportunities for impact investing to thrive, meeting SDG goals even beyond just ESG.

In the public markets, organizations have a framework for understanding how to use our philanthropic dollars in more innovative ways. That is what’s truly exciting about the future of impact investing.

What advice do you have for students entering the impact investing space?

I think the key thing is that it’s such a nascent space, most firms have the philosophy that even if you don’t have a finance background, it’s an area that can be learned. The terminology is hard, but a growth mindset is important to push through the uncomfortable to learn about finance and impact.

So, I would say don’t shy away if you are interested in the space but not a finance person. But if you are a finance person, I want you to think about the space and consider the importance of impact in your work. In terms of skills, I believe that critical thinking and independent thinking are important – whether or not you question your own thinking.

DISCLAIMER: the opinions expressed in interview responses do not necessarily reflect the views of the interviewer, Scholars of Finance, or Purposeful Finance by Scholars of Finance.

Recent Comments